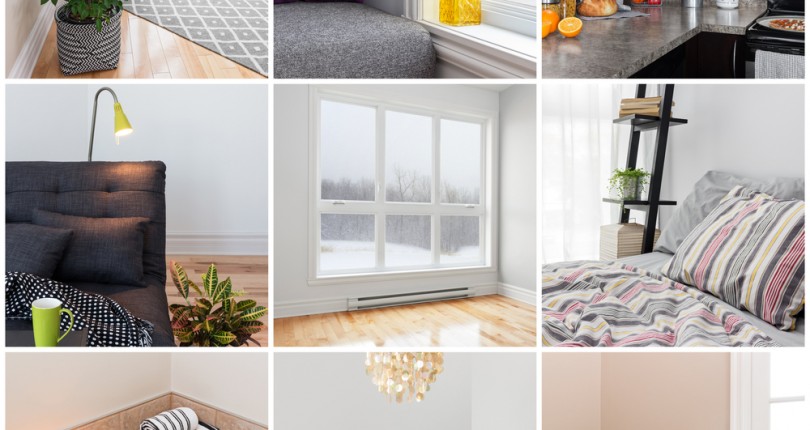

Moving From a House into a Condo

So you’ve made the decision to move from your house into a condo. Now what do you need to know? Let’s start with some things you’ll need to consider when moving from a house into a condo.

Moving from a house into a condo

What aspects of Condo life appeal to you the most?

Maybe you want a building or complex with a swimming pool, or other amenities like a fitness room, club house or guest suite. Does it have underground, secure parking? Is the location most important – near shopping, church, friends or family? Is the building concrete or wood frame (wood frame is always noisier than concrete/steel so keep this in mind)? Share your criteria. Then we can view the properties that closely match your requirements. Moving into a condo can be a big adjustment, so carefully evaluate what will make you feel most “at home”.

Financial considerations

When buying a condo, you need to consider more than just the purchase price.

- How much are the monthly strata fees and what do they cover? Look at strata fees at comparable properties to see if they seem high or low.

- How much is in the contingency reserve fund? This fund covers major building components in the event they need replacing and if the fund is low, it likely means you’ll get hit with a special assessment.

- Are there any current special assessments or levies the unit is responsible for? If there are, you’ll need to consider who should be paying them (you, the seller or both) and negotiate that as part of your purchase agreement.

Depreciation Report

This report has been legislated by the Government of B.C. and at some point, all strata’s will have to obtain one. Depending on the size of the strata and how many units there are, the price ranges from around $5,000 to $30,000 or more. The report is a long term look – usually 25 to 30 years – at every building component (roof, boilers, windows, building envelope and such), the expected remaining life of the component and a ballpark estimation of the replacement cost. These are then used for budgeting and planning by the strata council so contributions to the contingency reserve fund can be increased or special assessments can be levied. For major building components, replacement costs can be high, so it’s good to know what may happen over the next few years. If the strata haven’t obtained the Depreciation Report yet, try to find out why not. If they have one, make sure you find out if the strata is planning to implement any of the recommendations, and if so, when.

Downsizing your household content to fit into the condo

Unless you buy a condo with as many rooms, and as much space as your house, you’ll inevitably have to get rid of some of your belongings. We have more articles on decluttering your home, and deciding whether or not you want to obtain (or get rid of) a storage unit. We outline some great tips for downsizing and ways to recover some of the costs.

To contact Ian call or text (250) 616-3641 or email

Ask how Ian can develop an accurate evaluation of your home using a virtual meeting room from the comfort of your own home.

Future focused and positive

[ninja_form id=1]